Market Commentary - December 2021

A Change in the Air

Amplified by the pandemic, but facilitated by the Federal Reserve, we have seen several major speculative runs in various assets over the past two years. Some of these rallies have inspired both pros and commentators to toss around the “bubble” word. Unlike some of the more familiar or recent market bubbles (internet stocks in ’00, housing in ’06), the growing list of possible bubbles has led to the phrase “the everything bubble”. A problem with the “everything bubble” label is that many of today’s signs of froth or excess are showing up in somewhat small or niche corners of the economy or markets or they are not easily accessible or familiar to most. Venture capital is a huge corner of the finance and investing world, but it is not easily tracked by most investors and many of the new, more speculative assets such as NFTs are not trades on an exchange. If you are unfamiliar with the term, NFT stands for non-fungible tokens, which are unique, digital items stored on the blockchain. That does not mean that Wall Street (let’s loosely use the term) is not trying to get them to market! Barron’s recently commented on the birth of more and more creative funds coming to market, “Fund companies launched at least 64 new thematic ETFs (exchange traded funds) in the first 11 months of 2021, according to FactSet, more than double the average in the previous three years” ¹. And wouldn’t you know it, just a few days ago an NFT ETF was launched!

In the days after the covid shut down, trading in a handful of stocks became the new favorite pastime for some, as the usual menu of sports and entertainment dried up. This led to ridiculous moves in some obscure or small stocks, which was completely detached from fundamentals. This seemed harmless to most and not surprisingly, many of these stocks are currently well off their highs and some are back to where they started, without any noteworthy damage elsewhere.

Trading in bitcoin has been around for several years, but the reason for owning the cryptocurrency and others like it was made stronger by the Federal Reserve’s super easy policy and then punctuated by the unprecedented level of spending plans in Washington. The Grayscale Bitcoin Trust (GBTC) was below $9 at the end of 2019, then surged more than 600%, topping out around $58 in February of this year. Today it trades around $36.

No other stock better exemplifies the current day better than Tesla (TSLA). The company and its founder touch on so many of today’s popular themes, from electric vehicles to space and bitcoin, and very appropriately, Elon Musk was just named Time Magazine’s Person of the Year. Pre-pandemic, Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN) were racing to the $1 Trillion market cap level. At the close of 2019, TSLA was a measly $65 billion, but in early November its value had surged to more than a $1.1 Trillion! On November 6th, with his stock trading at nearly 18 times next year’s estimates sales, Musk put the question to a vote, asking the Twitter universe if he should sell some of his stock. Did this signal the top in TSLA’s stock? Well, there is no question that he is a very smart guy.

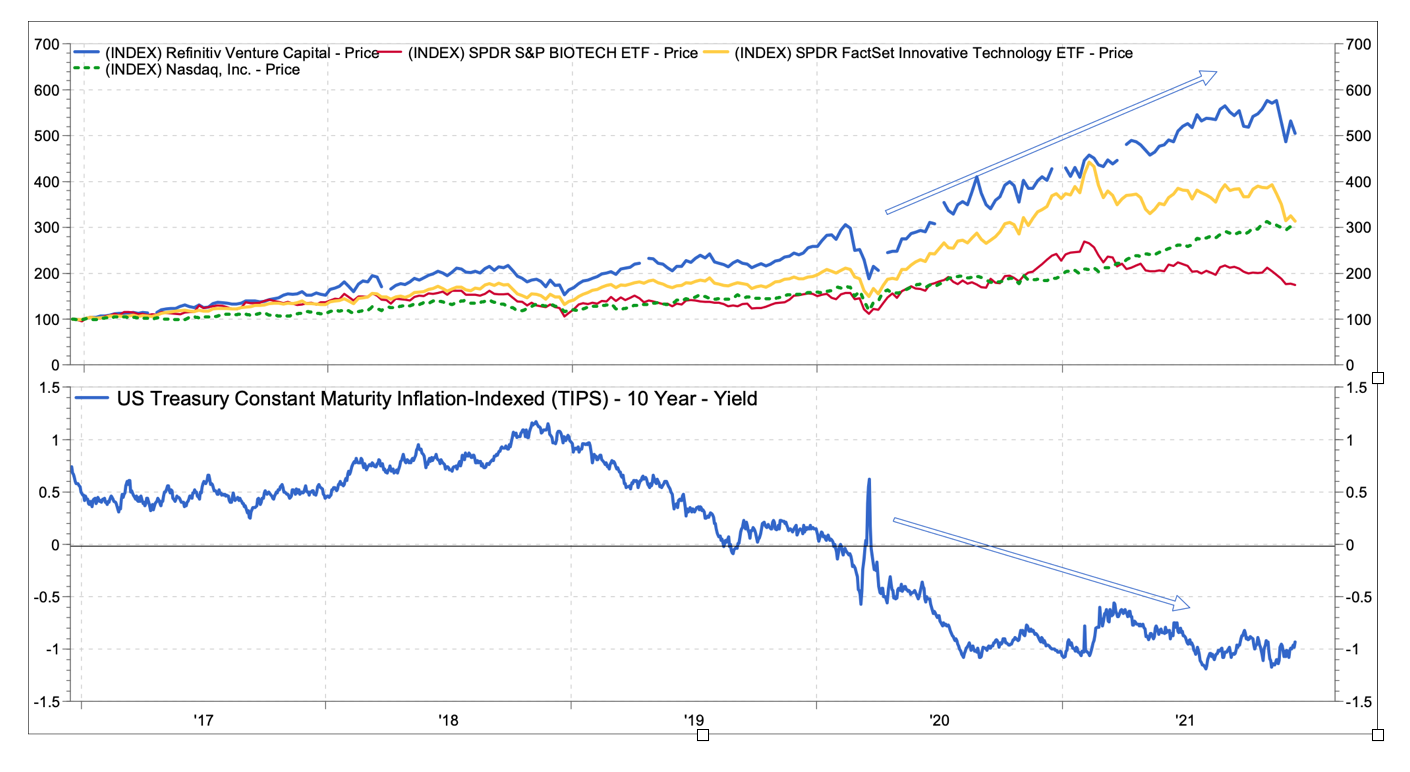

In recent weeks, there has been a noticeable change in the air, coinciding with comments from the newly reappointed Fed Chairman that the tapering of bond buying should be accelerated. Some of the once hot asset classes or stocks that have been market leaders in recent years are clearly acting poorly. The nervousness in certain corners of the market is coming at a time when new records are being set in terms of IPOs and money continues to flow into venture capital funds. After a record setting 2020, global IPOs raised the bar even further in 2021, as SPACs or special purpose acquisition corporations and companies are taking advantage of the lofty valuations and ample liquidity². The Refinitiv Venture Capital Index (TRVCI), the SPDR FactSet Innovative Technology ETF (XITK), the SPDR S&P 500 Biotech ETF (XBI), and the Greyscale Bitcoin Trust (GBTC), who have each had more than their moment in the sun in recent years, are each down between 12% and 28% in the past month. Favorably, traditional value stocks are flat over the past month or are holding up much better than these possibly former market darlings.

While much is made about the extremely loose monetary position that Powell and his Fed Board established in 2020 and maintained until just recently, this is the same Chairman who was raising rates until mid-2019, partly to counteract the fiscal stimulus provided by the Trump tax cuts. Could the punch bowl be taken away from the party? The outperformance of many of these non-yielding and more speculative assets and stocks certainly coincided with the Fed’s expanding balance sheet or bond buying, which sent real, or inflation adjusted interest rates below 0%. Today, inflation and real growth are significantly higher, which is promoting the reversal from the Fed, so it would be logical to expect higher interest rates. When you are offered nothing or less than nothing from the rate market, it is not surprising to see the market reach for other assets. Frankly, that’s the Fed’s intention! But the relative attractiveness of non-yielding assets like bitcoin, venture capital, or speculative equities is likely to continue to fall if investors can get real or higher income from the bond market.

To be clear, some of our portfolio holdings have in many ways benefitted from the recent market environment. In fact, our portfolios have performed very well during this rising tide, BUT we would emphasize that unlike static indices or niche ETFs, our active, value approach is geared towards avoiding overly stretched stocks and looking for opportunities where greater value is offered. We would not claim that our stocks are impervious from short term volatility or possible market downdrafts, but our approach to the market has not changed, therefore we trust that our process of portfolio construction and stock selection will continue to serve our clients well, throughout the market cycle.

Tyler Pullen, CFA

Portfolio Manager

¹Barron’s, “Thematic ETFs Can Get Too Cute What to Know Before You Invest” By Evie Liu December 10, 2021

²Bloomberg, “Global IPOs Blow Past $600 Billion Mark in Best Year on Record” By Swetha Gopinath, Myriam Balezou, and Julia Fioretti November 20, 2021

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A filing with the SEC is available to you upon request.