Q1 - April 2021

Quarterly Commentary

“Up and to the right” is a phase used in this business to describe a market or stock that rises consistently over time. For the past few months, it has been more of just an “up” market, and it has happened fast! Markets are doing what they always do, front running the actual economy, and generally following expectations and other leading indicators of future growth. Those forward-looking metrics have continued to improve as hope of a return to normal has become more of a reality. To be clear, the pace of activity remains very inconsistent across regions and various parts of the economy. A result of this has been disruptions within many supply chains as demand has bounced back for some products when producers or suppliers are not able to deliver. The labor market has healed faster than expected, but the weekly unemployment claims still sit above 700,000 versus the low 200’s that we saw in the years prior to the pandemic. Many of these empty positions are within service industries, but they are coming back quickly. A strong economy and the tightest labor market we had seen in decades prior to the pandemic surprised most economists when inflation did not accelerate. Despite more labor slack and portions of the country just now coming out of lockdown, inflation is the new #1 risk in the markets. According to the latest Bank of America/Merrill Lynch monthly survey of global portfolio managers, inflation concerns have bumped Covid-19 worries from the top market risk¹.

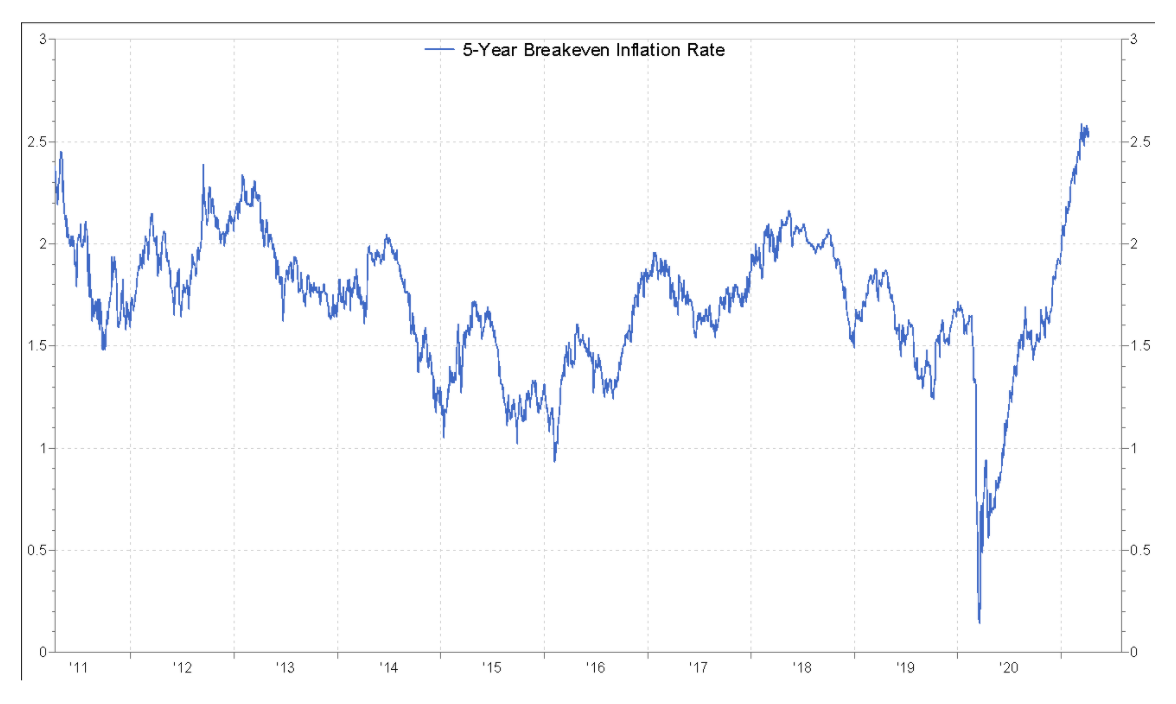

As a sign of this heightened expectation or concern in the markets, the break-even rates, or the difference between inflation protected treasury bond yields and straight bonds, have expanded to their widest levels since 2008.

One source of this inflation angst is the efforts of the new Administration to spend trillions more, on top of the $5 trillion spent in recent months. To put that into perspective, using 2019 values, the US spent $4.7 trillion to fight World War II². This urge to spend follows the shift made by the Federal Reserve last fall when Chairman Powell demoted their forward-looking models as their preferred tool to signal when to tighten policy rates. While they have been unable to stoke textbook inflation, asset values are far from deflated. US home prices rose 11.2% in the year that ended in January, its highest annual rate of price growth since February 2006³. To provide a sense of how low rates are in the bond market (and therefore how high prices are) Greece recently issued a 30-year bond at a yield of 1.93%!

Tyler Pullen, CFA

Portfolio Manager

¹ “Inflation overtakes Covid-19 as PMs' number one concern”, citywireusa.com, Michelle McGagh, March 17, 2021

² What were the 13 most expensive wars in U.S. history? John Harrington and Grant Suneson, 24/7 Wall Street, published in the USA Today, June 13 2019

³ U.S. Home Prices Rise at Fastest Pace in 15 Years, By Nicole Friedman, WSJ, March 30, 2021

Past performance does not guarantee future results. Market conditions can vary widely over time and can result in a loss of portfolio value. In accordance with the rules of the Securities and Exchange Commission, we notify you that a copy of our ADV, Part 2A filing with the SEC is available to you upon request.